You're doing everything right. Your budget is solid. You're investing consistently. Your financial life is on track. Then your car breaks down. A medical bill arrives. Your job suddenly ends. One unexpected expense derails months of progress. This is why an emergency fund isn't optional—it's foundational.

An emergency fund is money set aside specifically for life's unpredictable moments. It's the difference between handling a crisis and spiraling into debt. It's the safety net that lets you take calculated risks, change jobs, and weather storms without destroying your financial future.

Yet most people don't have one. Studies show 40% of Americans couldn't cover a $400 emergency without debt. This isn't a character flaw—it's a planning failure. The following guide explains how to build an emergency fund from scratch, how to calculate emergency fund needs, and where to keep your emergency fund.

What is an Emergency Fund?

An emergency fund is a stash of money reserved exclusively for unplanned financial emergencies. It covers things like sudden medical bills, urgent car repairs, home emergencies, or income loss. This is not money for vacations, shopping sprees, or fun purchases. It is your cushion when life throws you a curveball.

Think of it as self-insurance. Instead of relying on credit cards or payday loans when disaster strikes, you rely on your own cash reserves. A good emergency fund gives you the power to handle financial shocks without stress or debt.

How to Calculate Your Emergency Fund Amount

The most common question people ask is: how much should I save? To calculate your emergency fund, you need to know your essential monthly expenses. These are the bare-bones costs that you absolutely have to pay each month. Start by listing out your "four walls": housing (rent or mortgage), utilities (electricity, water, heat), food, and transportation (car payment, gas, insurance).

Once you have that monthly number, multiply it by your target number of months. Most financial experts recommend saving 3 to 6 months of essential expenses. For example, if your essential monthly expenses are $2,500, your emergency fund target would be:

Starter fund (3 months): $2,500 x 3 = $7,500

Fully funded (6 months): $2,500 x 6 = $15,000

If you are single with a stable job, 3 months might be enough. If you are self-employed, have dependents, or work in an unpredictable industry, aim for 6 months or more. To calculate your emergency fund needs accurately, track your actual spending for a month to see what your real essential expenses are, not what you think they should be.

-- Sponsored Content --

Track Your Spending with Rocket Money

Before you can save, you need to know where your money is going. Rocket Money (formerly Truebill) helps you see all your spending in one place, cancel unwanted subscriptions, and lower your bills automatically. It is the easiest way to find money to put into your emergency fund.

Find Extra Cash for Your FundIdentify wasteful spending and automatically save more with Rocket Money's smart budgeting tools. Join over 5 million users who have saved an average of $720/year.

Get Started with Rocket Money (Free)

How to Build an Emergency Fund (Step-by-Step)

Building an emergency fund does not happen overnight, but it is simpler than most people think. Here is how to do it, one step at a time.

Step 1: Start Small with $1,000

If the idea of saving 3 to 6 months of expenses feels overwhelming, start with a mini-goal: $1,000. This is enough to cover most minor emergencies like a car repair, a broken appliance, or an urgent trip to the dentist. Reaching $1,000 gives you momentum and a real sense of security. To get there fast, you might need to cut temporary expenses, pick up a side gig, or sell items you no longer need. Every dollar counts.

Step 2: Automate Your Savings

The easiest way to build your fund is to make it automatic. Set up a recurring transfer from your checking account to a separate savings account every payday. Even if it is just $25 or $50 per paycheck, it adds up fast. Automation removes the temptation to skip a deposit or spend the money elsewhere. You can use your bank's online tools or apps like Rocket Money or Qapital to automate the process. The key is consistency, not the amount.

Step 3: Cut Temporary Expenses

To build your emergency fund faster, look for temporary spending cuts. Cancel subscriptions you are not using, eat out less often, or skip that expensive coffee habit for a few months. These are not permanent sacrifices—they are short-term strategies to accelerate your progress. Once your fund is fully stocked, you can bring back the extras. But while you are building, every dollar you free up is a dollar closer to financial security.

Where to Keep Your Emergency Fund

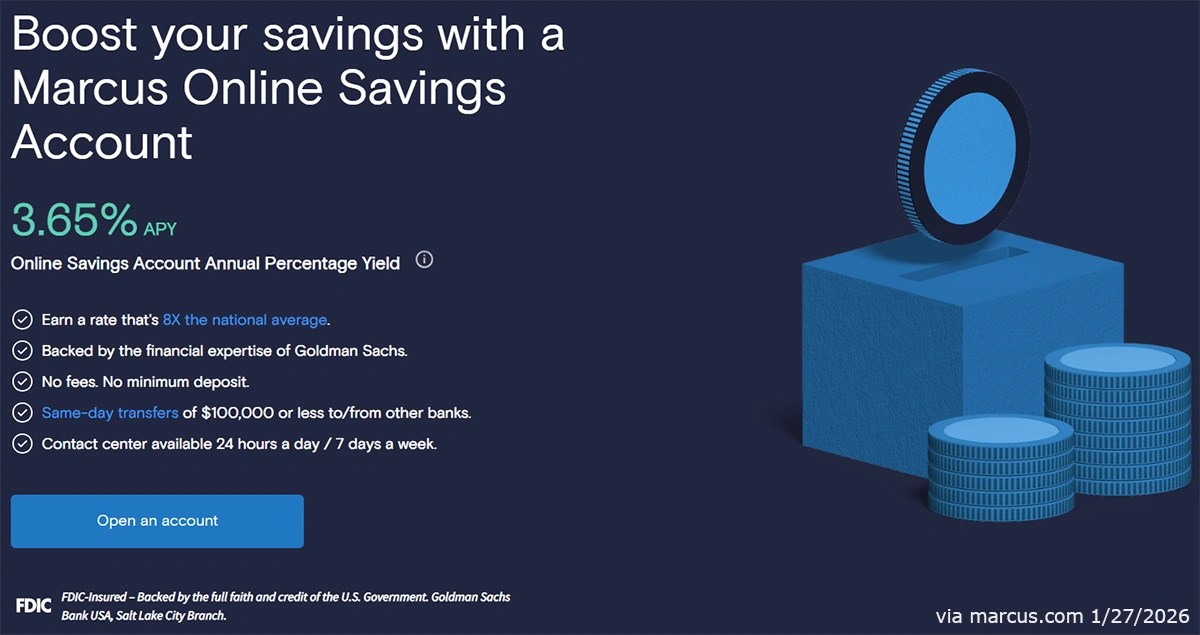

Once you start saving, the next question is: where should you actually keep this money? The best place to keep an emergency fund is in a High-Yield Savings Account (HYSA). These accounts offer much higher interest rates than traditional savings accounts (often 4% to 5% APY or more), which helps your money grow while staying completely liquid and accessible.

Your emergency fund should be easy to access in a true emergency, but not so easy that you are tempted to dip into it for non-emergencies. A HYSA strikes the perfect balance. You can withdraw money quickly when needed, but it is not sitting in your checking account where you might accidentally spend it. Look for accounts with no monthly fees, no minimum balance requirements, and FDIC insurance to protect your funds.

Some popular options include Marcus by Goldman Sachs, Ally Bank, and American Express Personal Savings. Avoid keeping your emergency fund in a regular checking account (too tempting to spend) or in investments like stocks (too risky and volatile).

Emergency Fund vs. Savings: What's the Difference?

It is easy to confuse the two, but they serve different purposes.

Regular Savings are for planned expenses (a "sinking fund"). You are saving to spend this money—on a wedding, a car, or a holiday.

Emergency Funds are for unplanned protection. You are saving this money with the hope that you never have to spend it. Keeping these pots of money separate is crucial for financial clarity.

Why is it Important to Have an Emergency Fund?

An emergency fund acts as a buffer between you and life's chaos. Without it, a single bad event can spiral into long-term debt. It provides the peace of mind needed to make better financial decisions. Without an emergency fund, unexpected expenses force you to use credit cards, raid retirement accounts, or ask family for money. With an emergency fund, you pay cash for emergencies, move forward without stress, and have options when life changes.

The Real Cost of No Emergency Fund

Without an emergency fund, unexpected expenses force you to:

- Use Credit Cards: You charge the $2,000 car repair. Interest compounds. What was a $2,000 problem becomes a $3,500 debt.

- Raid Retirement Accounts: You withdraw from your 401(k) or IRA. Penalties and taxes eat 30-40% of the withdrawal.

- Ask Family for Money: This can damage relationships and create awkward power dynamics.

- Downward Spiral: You're now in debt, stressed, and less able to earn or advance your career.

The Power of an Emergency Fund

With a 3-month emergency fund, that same car repair:

- You Pay Cash: No debt created. No interest paid.

- You Move Forward: Car is fixed. Life continues. No stress.

- You Have Options: If your job becomes toxic, you can quit. Your emergency fund buys optionality.

- You Build Wealth: Without emergency debt derailing progress, you can invest, save, and compound wealth over time.

This is the power of financial preparedness. It turns chaos into a minor inconvenience.

Action Plan: Your Next Steps

This Week:

- Calculate your monthly essential expenses.

- Set a target emergency fund goal (3-6 months of expenses).

- Open a High-Yield Savings Account (HYSA) at Marcus, Ally, or Amex.

This Month:

- Make your first deposit to the HYSA.

- Set up an automatic monthly transfer on payday.

- Secure your account with 2FA and get a VPN to protect it.

Within 2 Years:

- Complete your emergency fund.

- Begin serious investing with your surplus savings.

- Sleep better at night, knowing you have financial stability.

Frequently Asked Questions

Why is it important to have an emergency fund?

How much should be in an emergency fund?

How to calculate emergency fund needs?

Conclusion: Your Financial Foundation

An emergency fund isn't glamorous. It doesn't build wealth as quickly as investing. But an emergency fund is foundational. Without it, you're one crisis away from financial disaster. With it, you're financially stable.

Financial stability is the prerequisite for everything else. Start today. $50/month is enough. Automation is enough. Consistency is enough. Your future self will thank you for the security you're building now.

Understand your financial position with SmartCredit's $1 7-day trial and protect your emergency fund with Surfshark VPN—80% off plus 3 months extra.

Ready to Experience the Future of Surveys?

Now that you understand how AI is improving surveys, find platforms that leverage this technology to offer better experiences and rewards.

Explore Top Survey Platforms