How Selective Scamming Fools Even Experienced Earners

The rise of survey apps and get paid to platforms has created a strange contradiction: more people than ever are earning real money from surveys, and more people than ever are convinced they are being scammed.

Following high‑profile controversies and intense community scrutiny around apps like Benjamin One, it has become clear that the problem is not just obvious scams vs. legitimate sites. Instead, a more complex pattern has emerged in which some platforms appear to operate in a way that feels legitimate to many users while others report serious payout issues and account problems. In some cases, communities allege that only a subset of users are affected, which makes those complaints easy to dismiss.

Throughout, the goal is not to label specific companies as scams, but to give readers a practical framework for evaluating risk and protecting themselves.

The New Anatomy of a Survey Scam

Most people imagine a scam survey site as something crude and obvious: a website filled with pop‑ups, broken English, and promises of impossible earnings. Those still exist, but they are no longer the main threat. The more concerning cases are platforms that look and feel legitimate, pay some users consistently, and still generate serious allegations from others.

From Obvious Red Flags to Sophisticated Operations

Traditional scam survey sites share a few familiar traits. They might:

- Require upfront payments or membership fees to access surveys

- Promise unrealistically high earnings for minimal effort

- Redirect users through endless loops of qualifying questions without ever paying

- Push aggressive upsells unrelated to surveys, such as questionable subscriptions or services

These patterns are relatively easy to spot and avoid. Users quickly recognize that they are not being paid, word spreads, and the site either disappears or rebrands.

The more sophisticated cases are different. They often have:

- A professionally designed website or app

- A functioning survey system

- Real payouts to many users

- Active social media or community presence

On the surface, these platforms can look almost identical to well‑established, reputable survey sites. Yet in certain communities, users document experiences of account suspensions, reversed balances, or failed payouts that occur precisely when they reach higher thresholds or larger cash‑out levels.

The Concept of Selective Scamming

A growing number of users across different communities have described a pattern sometimes referred to as selective scamming. In this pattern, a platform appears to operate normally for most of its user base, while a smaller subset reports serious issues at critical moments—often at or near payout.

The Logic Behind the Pattern

If a platform refused to pay anyone, it would quickly be labeled a scam everywhere.

If it pays most people and only withholds payment or suspends accounts in a smaller percentage of cases, those affected users can be dismissed by others as unlucky, mistaken, or dishonest.

When those users speak out, they are frequently met with responses such as, "I’ve never had a problem, so you must have done something wrong."

From the outside, this creates a confusing picture. Review platforms and comment sections show:

- Many users reporting smooth payouts and positive experiences

- A smaller but persistent group reporting sudden problems when attempting larger or final cash‑outs

Because the majority is paid, community reports of non‑payment are easy to downplay. The result is a gray zone where a platform may appear legitimate to some and deeply problematic to others.

Negative reviews are often buried during selective scamming

Negative reviews are often buried during selective scamming

The challenge for users is that traditional legitimacy signals can still be present in these cases. A platform might have years of operation, a polished app, and many satisfied users—and still generate recurring community allegations that certain accounts are blocked, restricted, or closed when they reach particular payout levels.

Why Verification Has Become Much Harder

The usual advice for avoiding scams is to do research on platforms using tools like the Better Business Bureau (BBB), Trustpilot, and similar review aggregators. That advice still has value, but it is far less reliable in the survey space than many people assume.

The Problem with Review Platforms and Complaint Sites

Survey apps often have strict terms of service that prohibit entering inconsistent demographic information, creating multiple accounts, using VPNs, or selling account access. When a user violates these terms, their account may be restricted, closed, or flagged for review. From the platform’s point of view, this is fraud prevention. From the user’s point of view, it can feel like a sudden and unfair loss of earnings.

Some of those users then leave public reviews or complaints labeling the company a scam. In practice, this means:

- Even reputable, established survey platforms will have reviews that accuse them of being scams.

- Complaint volumes alone are not enough to determine whether a platform is genuinely engaging in misleading or abusive behavior.

- It is often difficult for outside observers to tell whether a given complaint stems from a platform’s actions or the user’s own violation of rules.

As a result, simply seeing scam in reviews is no longer meaningful on its own. What matters is the pattern of complaints, their specificity, and how those patterns compare against broader community discussions.

Examining user feedback patterns is crucial to avoiding scam sites

Examining user feedback patterns is crucial to avoiding scam sites

The False Confidence Problem

At the other extreme, a platform can also appear safe because it passes every traditional check: it has a professional site, positive reviews on BBB or Trustpilot, and active social media accounts.

However, selective scamming or inconsistent enforcement can still occur underneath these signals. A platform that pays many users and withholds payment from comparatively few can generate enough positive feedback to overshadow serious recurring issues. That is the false confidence problem: a site can look legitimate on paper while certain users continue to document similar, unresolved problems over time.

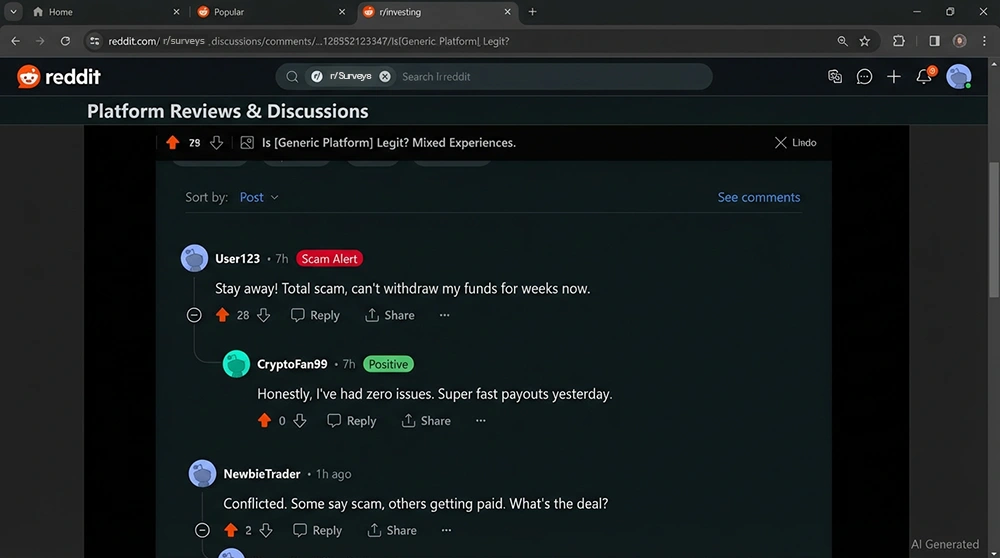

Why Reddit Communities Are Often the Best Early Warning System

For survey sites and apps in particular, Reddit has become one of the most useful places to research platforms before committing significant time. Unlike static review pages, subreddit communities allow users to post detailed experiences in real time, respond to each other, correct misunderstandings, and flag patterns.

Subreddits such as r/BenjaminOne, r/Qmee, and r/beermoney illustrate how this process works in practice. When a platform is functioning well, users share payment proofs, tips, and tricks. When something changes—payout delays, account issues, policy shifts—those changes are often visible in aggregated discussion threads.

How to Use Reddit to Research a Survey Site

- Search for the platform’s name in relevant subreddits.

- Look for monthly or ongoing discussion threads where users regularly report their experiences.

- Pay attention to posts where multiple people describe similar issues, especially over a span of weeks or months.

- Notice whether moderators or experienced community members reference documented patterns, pinned posts, or warning threads.

- Compare fresh posts with older ones to see whether issues are new, intermittent, or long‑standing.

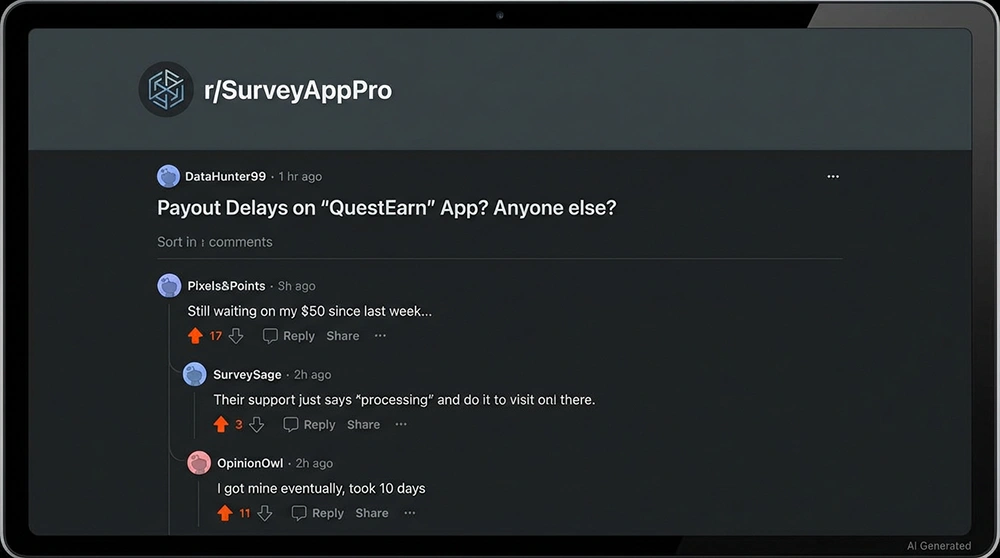

When it comes to avoiding scam survey sites, Reddit is your friend

When it comes to avoiding scam survey sites, Reddit is your friend

The most useful signals include consistency over time, multiple independent users describing comparable problems without prompting, and specific details like dates and thresholds rather than vague accusations. A single angry post does not prove anything. A multi‑month pattern of similar experiences, documented by different users and recognized by the community, is difficult to dismiss.

The Red Flag Checklist: Assessing Survey Site Risk

Because of the complexities described above, the goal is not to find a magical way to guarantee that a site is legitimate. Instead, the goal is to assess risk in a structured way and to recognize when warning signs start to stack up.

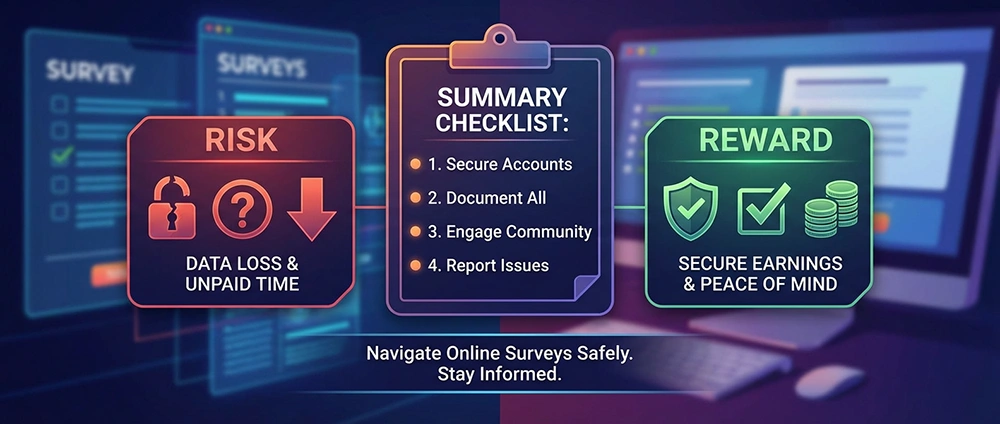

If You Believe You Have Been Selectively Scammed

Despite best efforts, some users will still encounter serious problems. When that happens, there are practical steps that can help protect both financial and personal information.

Review recent transactions on PayPal or bank accounts connected to the platform. Change passwords on linked accounts, enable two‑factor authentication, and revoke permissions or disconnect accounts where possible.

Before closing accounts, take screenshots of balances, pending payouts, and relevant messages. Save email communication. Note dates and times. This documentation is useful if the issue escalates.

Share experiences in appropriate communities to determine if others are experiencing similar issues and to alert users. Present facts clearly—communities respond better to detailed timelines than general accusations.

Depending on severity, file a complaint with consumer protection agencies (like the FTC), contact payment providers about unauthorized charges, or submit a factual, detailed review describing what happened.

Conclusion: Verification Is About Patterns, Not Perfection

Modern survey sites exist on a spectrum. The most important shift in mindset is to move away from the idea that a single signal can prove a platform is safe.

Instead, look at patterns in community discussion over time. Treat recurring, specific, and well‑documented complaints as meaningful. Recognize that both legitimate enforcement of terms and unfair treatment can generate similar accusations, so context is essential.

No framework can eliminate risk entirely. However, by understanding how selective scamming can operate and why traditional review platforms can mislead, you can make far more informed decisions about where to invest your time.

Ready to Start Earning?

Pick one platform, commit to consistent daily use, and watch your survey earnings grow.

Compare Top Survey Platforms Now