If you've been earning extra cash through Qmee, you've likely noticed some concerning changes lately. PayPal and Venmo cashouts have disappeared, Reddit threads are full of worried users, and official communications from the company have been sparse at best. Now, UK government filings confirm what many feared: Qmee Ltd has entered liquidation.

But before you panic about losing your earnings or finding a new survey app, the full story is more complex than a simple shutdown. Here's everything we know about what's happening with Qmee, what it means for users, and whether you should be looking for alternatives.

The Official Story: Qmee Ltd Is Being Liquidated

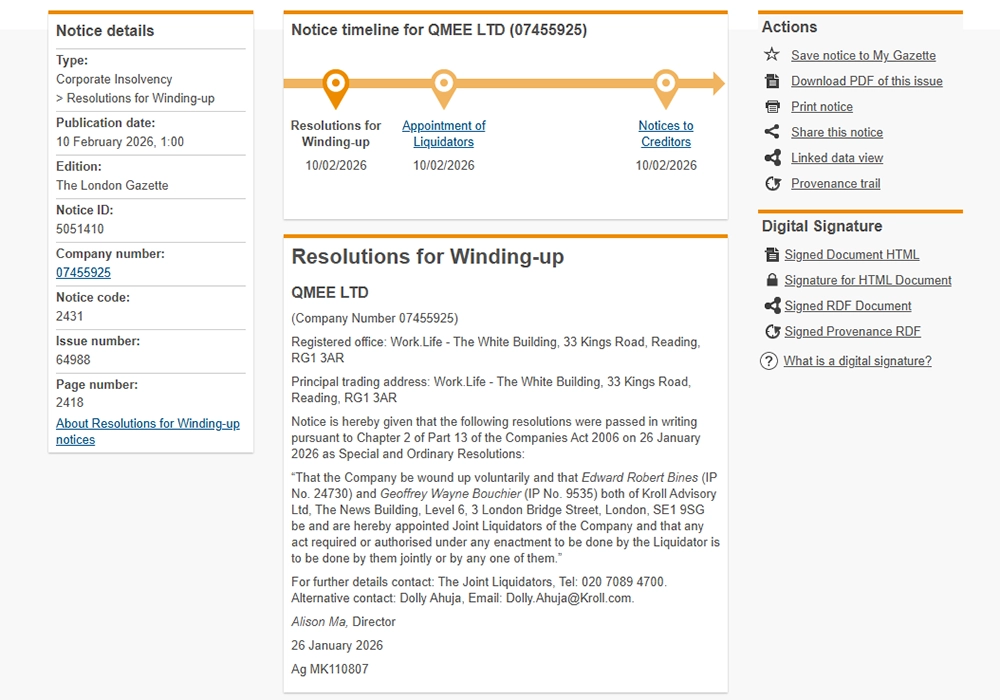

On January 26, 2026, Qmee Ltd officially entered what's called a Members Voluntary Liquidation (MVL). The company appointed Edward Robert Bines and Geoffrey Wayne Bouchier from Kroll Advisory Ltd—one of the world's largest restructuring firms—as joint liquidators to oversee the wind-down process.

The liquidation was formally announced in The Gazette, the UK's official public record, on February 10, 2026. According to Companies House records, the company filed a Declaration of Solvency on January 26, 2026, stating that Qmee could pay all its debts in full within 12 months.

The Gazette announcement confirms Qmee Ltd entered Members Voluntary Liquidation on January 26, 2026.

The Gazette announcement confirms Qmee Ltd entered Members Voluntary Liquidation on January 26, 2026.

This is where things get interesting—and why this might not be the disaster it initially appears.

What "Members Voluntary Liquidation" Actually Means

The type of liquidation matters enormously. A Members Voluntary Liquidation is specifically for solvent companies—meaning companies that have more assets than debts and can pay everyone they owe. This is completely different from bankruptcy or insolvency.

MVLs are commonly used when:

- A parent company wants to dissolve a subsidiary after acquisition

- Companies are restructuring their corporate entities

- Shareholders want to wind down a profitable business for tax efficiency reasons

Think of it as a planned, orderly closure rather than a distressed failure.

The Numbers Tell a Revealing Story

Qmee's Declaration of Solvency, filed with UK authorities and signed by directors Alison Ma and James Lavell, provides a financial snapshot as of January 8, 2026.

The company's assets totaled £550,341.50, consisting entirely of intercompany receivables—money owed to Qmee from related companies, likely Kantar entities. The company had only one liability: £53,806 owed in taxes. After paying all debts, Qmee would have an estimated surplus of £496,535.50.

Here's what's notable about those numbers: Qmee Ltd had no cash in bank accounts, no physical assets like office equipment, no intellectual property listed separately, and no operational infrastructure. The company was essentially an empty corporate shell by early January 2026.

Even more telling, the declaration notes that "the costs of the liquidation are to be met by a third party"—meaning Kantar or another related entity is paying for the entire liquidation process. This is standard practice when a parent company is consolidating subsidiaries after acquisition.

The Kantar Acquisition: Where This All Started

To understand what's happening now, we need to rewind to May 2022. That's when Kantar, a global marketing data and analytics giant, acquired Qmee from capital D, the private equity fund that was the majority owner.

At the time of acquisition, Qmee was performing well. The company had experienced 44% year-over-year growth and 119% growth since 2019. Kantar integrated Qmee into its Profiles Division, which handles primary research and consumer data collection.

The acquisition made strategic sense for Kantar. Qmee's platform gave them direct access to millions of engaged users willing to share opinions and data through surveys—exactly the kind of first-party data that's become increasingly valuable in the digital advertising ecosystem.

What's Been Happening to Users

While the corporate restructuring was happening behind the scenes, Qmee users started experiencing problems in late 2025 and early 2026.

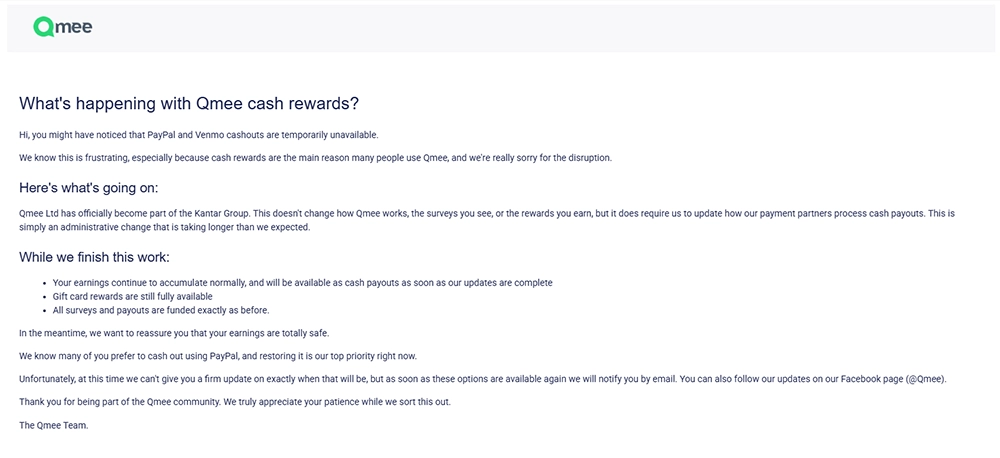

Around January 2026, PayPal and Venmo cashout options began experiencing technical issues. By mid-February 2026, both payment options were completely removed from the app. Qmee's official Facebook page stated the changes were "because Qmee has recently become part of the Kantar Group," though this explanation came nearly four years after the acquisition.

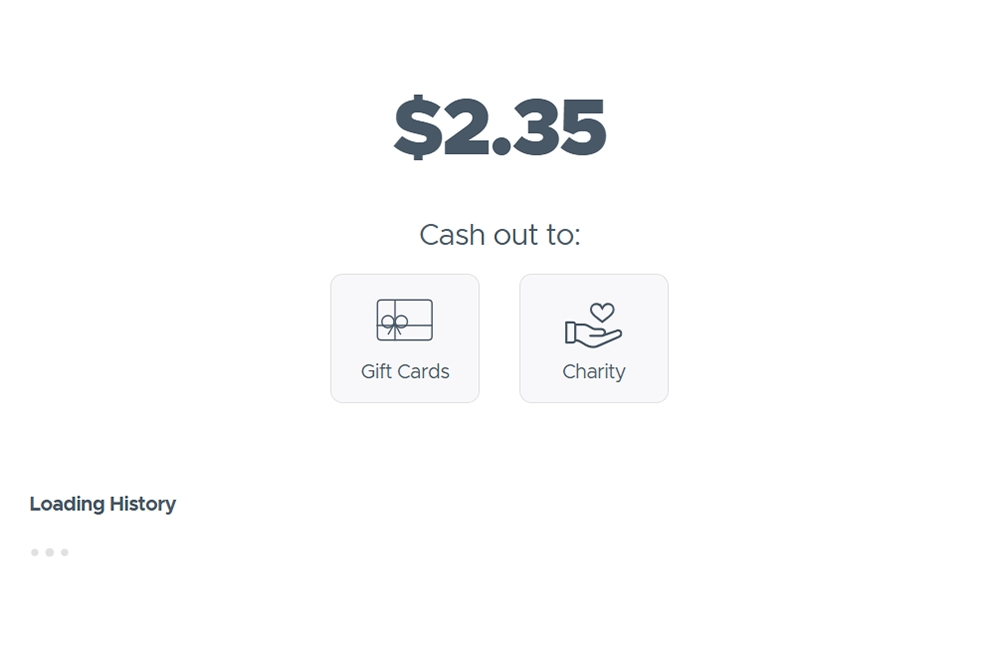

The Qmee app now shows only gift card redemption options after PayPal and Venmo were removed.

The Qmee app now shows only gift card redemption options after PayPal and Venmo were removed.

Gift card redemptions have continued to function throughout this period, and the app itself remains operational with surveys still available. However, user complaints about account suspensions, survey disqualifications, and payment issues increased significantly during this timeframe.

The lack of clear communication about the liquidation has left many users confused and concerned about whether they'll receive their earnings.

Who Is Kroll and Why Does It Matter?

Kroll Advisory Ltd, the firm handling Qmee's liquidation, is one of the world's premier restructuring and insolvency firms with nearly 5,000 professionals in over 30 countries. They've managed restructurings totaling more than $300 billion.

Companies don't hire Kroll for small-scale operations. The firm is expensive and typically brought in for complex, high-value liquidations involving substantial assets or cross-border complications. Kroll's involvement suggests this is a sophisticated, planned restructuring rather than an emergency situation.

The two liquidators appointed—Edward Bines and Geoffrey Bouchier—are licensed UK insolvency practitioners. Their job is to take control of Qmee Ltd's assets, pay any creditors, handle legal compliance, and distribute remaining assets to shareholders (in this case, Kantar).

So Is Qmee Actually Shutting Down?

This is the million-dollar question, and the honest answer is: we don't know for certain, but probably not entirely.

Evidence suggesting this is restructuring, not shutdown:

- The MVL structure indicates Qmee Ltd was solvent and capable of paying debts. Companies going out of business typically can't pay their debts and enter different types of insolvency proceedings.

- The app continues functioning with gift card options available.

- Kantar is paying liquidation costs, which is standard when dissolving subsidiary entities during corporate integration.

- The financial records show the UK entity was already an empty shell—operations and assets had likely already transferred to Kantar before liquidation began.

Evidence that gives users reason for concern:

- The removal of PayPal and Venmo—the most popular cashout methods—significantly impacts user experience.

- There has been no official communication explaining the liquidation to the user base.

- User experience has reportedly degraded substantially since late 2025.

- Both co-founders, Jonathan Knight and Nicholas Sutton, resigned as directors in August 2024, months before the liquidation.

The Most Likely Scenario

Based on the evidence, the most probable explanation is that Kantar is dissolving the "Qmee Ltd" legal entity as part of fully integrating Qmee's operations under Kantar's corporate structure. This would be a routine business decision for a large corporation four years after an acquisition.

The Qmee app and service would continue operating, but under different legal ownership—likely a Kantar entity rather than the standalone "Qmee Ltd" company. This would explain:

- Why it's a solvent liquidation rather than bankruptcy

- Why the UK company was essentially empty by early 2026

- Why operations are continuing despite the liquidation

However, the degraded user experience and payment options suggest Kantar may be shifting how the platform operates or potentially scaling back certain features.

What Should Qmee Users Do?

If you're currently using Qmee, here's practical advice:

Action Steps for Qmee Users

- Cash out regularly. Don't let significant balances accumulate. With gift cards still functioning, redeem your earnings frequently rather than waiting.

- Diversify your survey apps. Even if Qmee continues operating, having alternatives protects your earning potential. Consider platforms like Swagbucks, Survey Junkie, or InboxDollars as backups.

- Monitor official communications. Watch Qmee's social media channels and email for updates about payment options or platform changes.

- Document your earnings. Keep records of your account balance and any pending payments in case you need to file a claim during the liquidation process. The deadline for creditors to prove debts is March 19, 2026.

- Be realistic about the future. Even in the best-case scenario where the service continues, user experience may change under Kantar's full control.

Users should save any official communications regarding account status or payment changes.

Users should save any official communications regarding account status or payment changes.

The Communication Gap

One aspect worth noting is how this situation has been handled from a user perspective. The liquidation proceedings were initiated in late January 2026 and formally announced in early February, yet there appears to have been no proactive communication to users about what this means for the platform.

For a service that relies entirely on user participation and engagement, this silence creates unnecessary anxiety. Whether the platform is continuing under new ownership or winding down entirely, clear communication would have been beneficial. Users invest time earning through the platform and deserve transparency about its future.

The Bottom Line

Is Qmee shutting down? The UK company "Qmee Ltd" is definitively being liquidated through a formal legal process. However, this appears to be a solvent wind-down of a corporate entity rather than a service shutdown.

The most likely scenario is that Kantar is dissolving the subsidiary after fully integrating Qmee's operations into its own corporate structure. The app may continue operating under Kantar's ownership, though possibly with reduced features or different payment options.

For users, the practical reality is the same either way: the experience you've known is changing. Whether that means the complete end of Qmee or a transformed version under Kantar's control remains to be seen. The removal of major payment options and lack of clear communication suggests caution is warranted.

If Qmee has been part of your side hustle strategy, now is the time to diversify. Cash out regularly, explore alternative platforms, and don't rely on any single app for your extra income. In the gig economy and survey space, flexibility and having multiple income streams isn't just smart—it's essential.

The coming months should provide clarity on Qmee's ultimate fate. Until then, proceed with informed caution.

Frequently Asked Questions

Related Resources

Ready to Start Earning?

Explore our comprehensive reviews of money-making platforms and find the best opportunities for your situation.

Compare Top Earning Platforms Now